Tenant Insurance

4/7/2021 (Permalink)

Rental Insurance

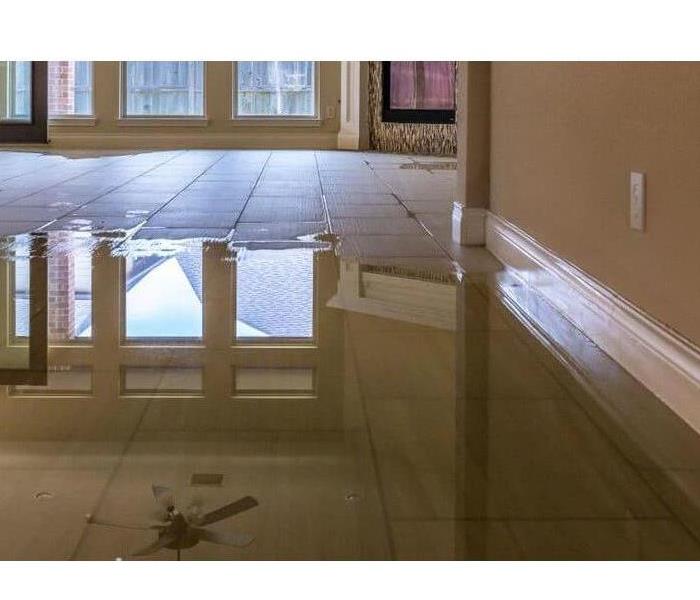

It is a good idea to have a rental insurance policy in the event of an accident. Many property managers require rental insurance. Coverage can vary from policy to policy. Some policies cover property damage, theft, personal belongings and even lodging in the event of a displacing emergency. It’s a good idea to look into obtaining a rental insurance policy, and if you already have one, it’s good to be familiar with what is and what is not covered.

Property management/ owner duties

Any landlord is responsible for keeping the apartment maintained to an acceptable level of livability. Basic plumbing, appliance and electrical maintenance is the responsibility of the landlord, as is basic property upkeep. The landlord can be held negligible for damage incurred due to failing to perform these basic functions.

Damage to personal property

Damage to the building itself, as well as utilities and appliances should be covered by the property owner’s insurance policy. Damage to personal property falls under the responsibility of the party who caused the damages, which may or may not be the tenant.

We are always here to help (909) 758-0189

24/7 Emergency Service

24/7 Emergency Service